Medicare and Medicaid are two different government programs for healthcare. It is important to understand…

How to Appeal a Health Insurance Claim Denial

Determine the Reason for Denial

First, you must find out why the insurance claim was denied The insurance company is required by federal law to provide you with a reason for the denial, which is most likely contained in your denial letter. But sometimes insurance companies don’t follow the law and fail to provide an adequate explanation for the denial. In this case you’ll need to call the insurance company to get that information.

Read Your Insurance Policy

It is important to understand what your health insurance policy covers and how your insurance handles co-pays. Keep a copy of your health insurance policy. If you do not have a copy, your employer’s benefits department or insurance company can provide one.

Know Your Deadlines

Your health plan should include rules and deadlines for filing a denial appeal. The denial letter should also contain the insurance company’s contact information and instructions on how to submit an appeal. The denial for submitting an appeal is typically 180 days from the date of denial.

Respond and Present Your Case

The way you respond depends on the reason for the denial. There are many reasons insurance companies deny claims, such as:

Clerical or Coding Error

If the denial is based on improper coding or some other clerical error on the part of the doctor or other billing provider, call the provider’s office. You can then ask them to re-submit a corrected bill to the insurer.

Most providers’ billing office staff are very helpful. If they aren’t, and they give you a hard time about re-submitting the bill, you might gently remind them that Virginia law (Va. Code § 8.01-27.5(B)) requires all in-network providers to submit proper claims on a patients’ behalf as long as the patient has given the provider his or her valid insurance information.

Excluded Services

If the denial is based on the insurance company’s determination that the services at issue are not covered, get a full copy of your health insurance policy. This copy must provide a list of excluded services.

If the claim involves payment for a medication, make sure the drug at issue is not included in the plan’s formulary or drug list. This list shows the prescription drugs your health plan covers.

Often, generic drugs are covered in a formulary whereas their brand-name equivalents are not. In that case, you might want to check with your provider to see if a generic equivalent is available. If it’s not, see Denial Reason #3 below.

Treatment Deemed Not Medically Necessary

If the denial is based on the insurance company’s determination that the care at issue is not medically necessary, begin by working with your provider’s staff. Work to compile evidence demonstrating that the care you received (or will receive) is medically necessary. You might even ask your provider to write a letter to the insurance company on your behalf. Whether you or your provider compiles and explains the evidence, be sure to include:

- A full history of your relevant health problem(s).

- Any treatments or therapies you’ve tried and the deterioration in your condition following those treatments.

- Any supporting medical literature, such as peer-reviewed journal articles, such as JAMA or NEJM, or treatment guidelines from esteemed medical organizations, such as the American Medical Association.

Out-of-Network Provider

The denial may be based on the insurance company’s determination that the care at issue was delivered by an out-of-network provider. You may be able to successfully appeal a denial if you demonstrate that there were no in-network providers in your area capable of providing the care.

In your appeal letter, also include documentation (such as a physician’s letter) showing that the service you received was medically necessary for your condition.

Failure to Adhere to Step Treatment Requirements

Step-treatment requirements are policies which require a patient to try less-expensive drugs or treatments before “stepping up” to pricier drugs and treatments. If the denial is based on the insurance company’s determination that the care at issue did not adhere to step-treatment requirements, then check your health plan. Determine what step-therapy measures, if any, must be attempted before the care you received can be covered under your health plan.

If you have fulfilled the requirements, provide documentation of your treatment course in your appeal letter. If you have not fulfilled the requirements, ask your provider to write a letter explaining why it was medically necessary to circumvent the insurer’s preferred treatment for a more expensive treatment.

Benefit Limits Exceeded

If the denial is based on the insurance company’s determination that the care exceeded benefit limits, first determine what benefit limits your plan actually has. Under the Affordable Care Act (“Obamacare”), as of 2014, health plans cannot put an annual or lifetime dollar limit on spending for health services considered “essential.”

However, they may impose other limits, such as how many times a person can receive a certain type of care. For example, a plan may cover only 20 sessions of physical therapy for a single condition or injury per year. In your appeal, include a letter from your provider to your insurance company stating why the services they provided are essential, and should not be subject to benefit limits.

No Pre-Authorization Submitted

If the denial is based on the insurance company’s determination that no pre-authorization was submitted for the care at issue, contact your provider. Determine whether or not they obtained prior authorization from your health plan for the services you received.

If your provider did receive authorization, they should be able to provide you with an authorization number. You should include this number in your appeal letter, along with a statement from your provider about why the services you received were medically necessary.

If pre-authorization was not obtained because you received care on an emergency basis, then state in your appeal letter that pre-authorization was impossible to obtain. If pre-authorization was not submitted due to an error on your provider’s part, and your provider is in-network, you might ask your insurer to overturn their decision. This would be done on the grounds that you should not be held liable for your provider’s failure to take appropriate action.

It is important to note that only “grandfathered” health plans are exempt from annual and lifetime dollar limits, and such plans are exceedingly rare. “Grandfathered” plans must have been purchased by an individual, not through their employer, prior to March 23, 2010.

Expedited Appeals

Appeals of health insurance claim denials take time, but if your situation is medically urgent, you may be entitled to an expedited appeal. A claim is considered medically urgent if:

- You are currently receiving treatment and your provider believes a delay could jeopardize your life or overall health, affect your ability to regain maximum function, or subject you to intolerable pain

- Your claim is related to an admission or continued inpatient hospital stay and you have not yet been discharged

In these cases, the insurer must respond to your expedited appeal request within 24 to 72 hours. The decision may be delivered verbally but must be followed by written documentation within the following 72 hours. You are not entitled to an expedited appeal if:

- You have already received the treatment at issue.

- Your situation is not considered urgent by a medical provider with knowledge of your medical condition or the medical director of your insurance plan.

Keeping Records Matters

In all of the steps listed above, make sure you keep good records, including:

- All letters received

- Notes recording the names of all insurance representatives

- Healthcare provider’s staff members you speak with

- The date, time, and details of all communications

Contact Norton Health Law Today

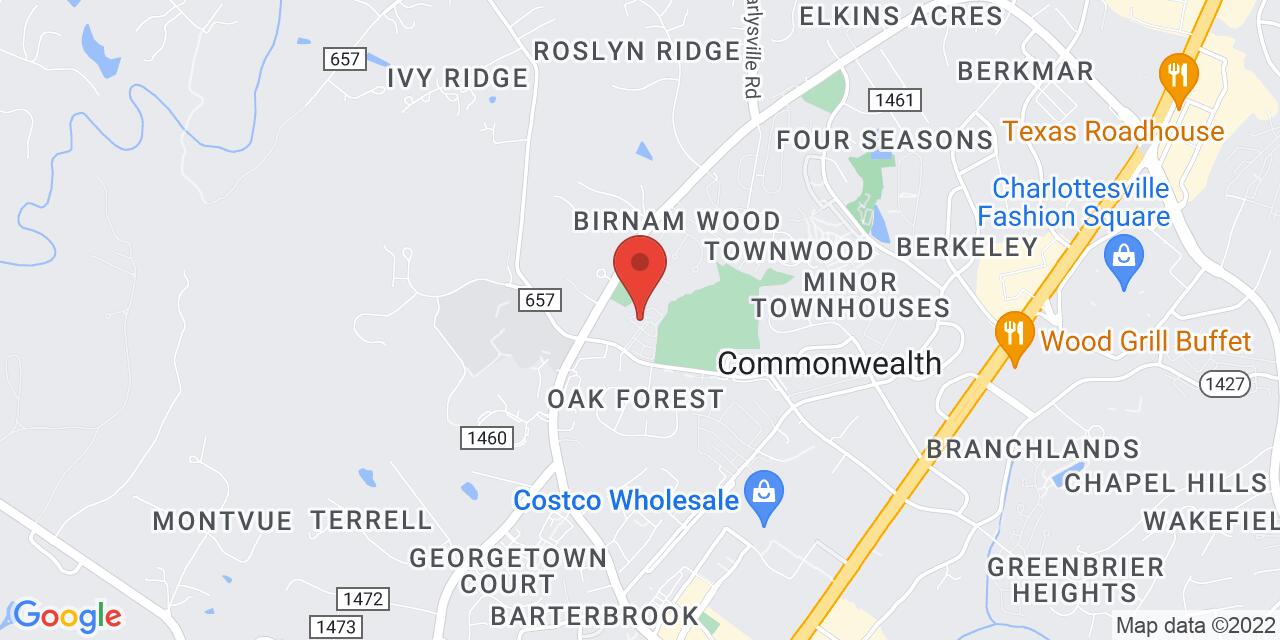

If you have exhausted all levels of the administrative appeals process without a satisfactory result, our team at Norton Health Law can help you fight your insurer’s decision. We are committed to improving the quality and length of our client’s lives by advocating for their healthcare rights.

Give us a call at (434) 978-3100 to request a free initial consultation to discuss your case and how we can assist you.