In preparation for your initial estate planning consultation, we thought it would be helpful to…

What Are the 5 Components of Estate Planning?

No one can anticipate what the future may hold, but you can ensure you are prepared for it by creating an effective estate plan. Having an estate plan in place will allow you to care for your loved ones after you are gone, giving them less to worry about as they navigate their loss. An estate plan can do more than simply distribute your assets after you die, however, so keep reading to learn more.

Essentials for Estate Planning

A well-rounded estate plan can help you prepare for anything.

Here are the 5 main components involved:

- Will: The component of estate planning most are familiar with is a will. Through a will, you can determine who will receive your property and assets after you die. Additionally, if you have minor children, you can assign a guardian to care for them if you and their other parent die.

- Trust: A trust is an important part of estate planning because it allows assets and property to transfer to your beneficiaries without having to go through the probate process. Moreover, you can also state how you want your beneficiaries to inherit the assets you leave for them, such as requiring young beneficiaries to receive their inheritance over time rather than as a windfall they may not be mature enough to handle. A trust can also provide asset protection from your creditors (including nursing homes) ensuring your hard-won property passes to your loved ones and that they receive all the tax benefits the law provides. There are many other uses of trusts, including special needs trusts to provide benefits for loved ones who receive public health and other benefits.

- Durable Power of Attorney: With a power of attorney, you can designate someone to act on your behalf and manage your finances in the event you become incapacitated or otherwise unavailable and unable to carry out these tasks on your own. If you become incapacitated without one, the court may have to assign someone to handle your financial affairs, and it may not be a person you would have chosen.

- Advance Medical Directive: Much like a power of attorney, an Advance Medical Directive allows you to give someone the power to make medical decisions on your behalf if you can no longer make them yourself.

- Beneficiary designations: You can make beneficiary designations on certain accounts, such as your retirement account, bank account or life insurance policy. These designations will supersede anything in your will, so be sure to regularly review them.

Schedule a Consultation with a Skilled Estate Planning Attorney to Get Started!

At Norton Health Law, P.C., our knowledgeable estate planning team can help you plan for the future. Let our experienced attorneys provide the guidance and advice you need to ensure your loved ones are cared for after your death.

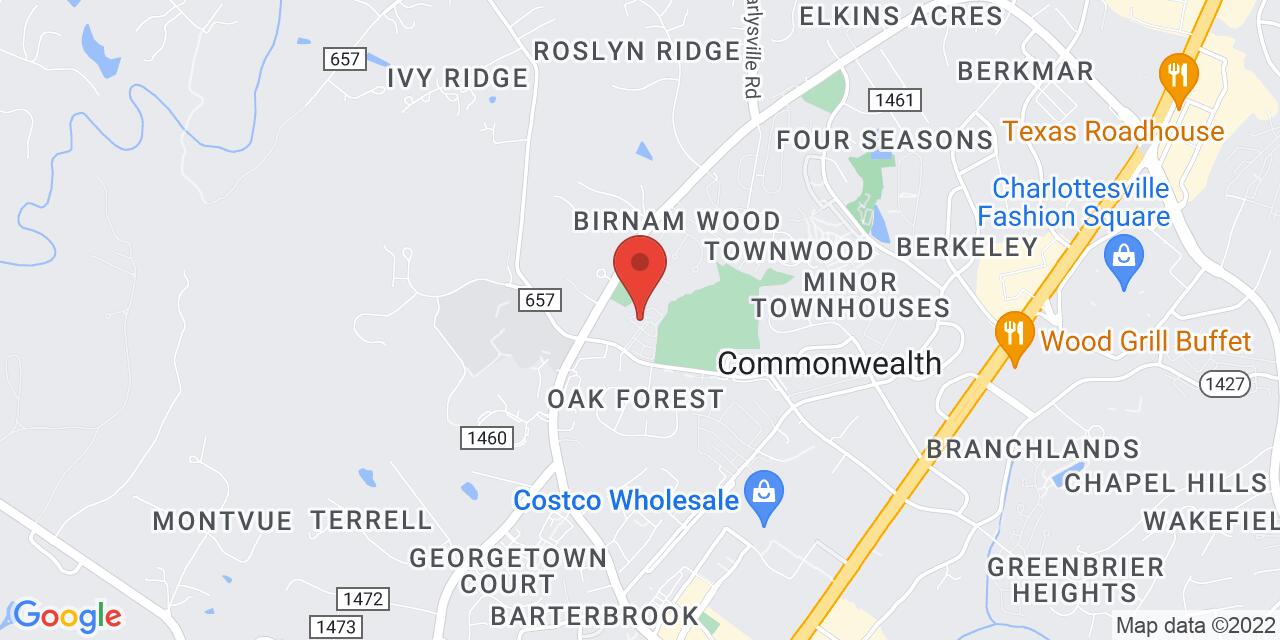

Reach out to our law office today at (434) 978-3100 to schedule a consultation with a member of our team to get started on creating your estate plan!