A week before my spring 1L finals at Washington and Lee School of Law, my…

What Is the Difference Between Medicare and Medicaid?

Medicare and Medicaid are two different government programs for healthcare. It is important to understand the difference between them. Incorporating Medicare and Medicaid benefits into your estate and financial planning is an important aspect of elder law.

Here, we will discuss how the program benefits differ, how eligibility for each program is established, and discuss some recent news pertaining to each program.

Medicare Program Benefits

Medicare is a program administered by the federal government to provide healthcare to certain populations. Original Medicare is divided into Parts A and B.

Medicare Part A covers hospital care and a limited period of nursing home care, home health services, and hospice care.

Medicare Part A will only cover nursing home care if the following is true:

- There was first a qualifying hospital stay of 3 days of inpatient care; and

- Nursing home care was needed relating to the hospital stay; and

- The patient entered the nursing home within a short time of the hospital stay (usually within 30 days).

Thereafter, only the first 20 days of nursing home care are paid for by Medicare Part A. Days 21 through 100 of care require a partial payment by the patient. Any care after 100 days is not paid at all by Medicare Part A.

Medicare Part B covers traditional healthcare expenses, such as visits to a doctor, blood tests, and X-rays. A referral is not needed to see a specialist in most cases. Original Medicare does not cover prescription drug coverage; however, you can enroll in Medicare Part D through a private insurance company with paid premiums.

Medicare Eligibility

Eligibility for Medicare is simple. If you are over age 65 and have paid Medicare tax through your employment for at least ten years, you qualify.

You can get Medicare Part A at age 65 without paying any premiums in any of these circumstances:

- You receive Railroad Retirement Board benefits; or

- You are eligible to receive Railroad Retirement Board benefits or Social Security benefits but have not yet filed for them; or

- You or your spouse had Medicare-covered government employment.

If you or your spouse doesn’t qualify for Medicare Part A because neither of you paid Medicare tax through your employment, you may still be able to obtain Medicare Part A via paid premiums. Eligibility for Medicare Part B is the same as for Part A but requires a paid premium. Some folks qualify for Medicare benefits even though they are under age 65, including younger people with disabilities and those with End-Stage Renal Disease.

Medicaid Program Benefits

Medicaid provides medical benefits to certain populations. It is a joint federal-state program. While states receive federal funding and must follow specific federal rules, each state administers its own Medicaid program. Medicaid covers all types of medical care, including long-term care, such as a nursing home. However, eligibility criteria are more stringent when trying to qualify for long-term care.

Medicaid Eligibility

Eligibility for Medicaid is needs-based. Income restrictions for programs cover pregnant women, children, the disabled, and the elderly. If your income is under the amount specified for your state, then you likely qualify if you are in one of those groups.

If long-term care is needed, there are also asset restrictions. An applicant cannot have over a certain amount of assets and still qualify for nursing home care benefits. Applicants can retain an elder law attorney to create an estate plan that protects assets while still qualifying for Medicaid benefits. Money and property are preserved for their family instead of being spent on care.

In addition to income and asset rules regarding nursing home Medicaid benefits eligibility, there is a look-back period. Suppose you had transferred assets during a specific time period before the Medicaid application was submitted. In that case, you will likely receive a penalty where you are not eligible for benefits for a period of time. Again, an experienced elder law attorney can help you navigate the application process to best manage any prior transfers for your benefit.

Recent Developments in Medicare and Medicaid

A few months ago, the Beneficiary Enrollment Notification and Eligibility Simplification (BENES) Act was signed into law. It eliminates the long waiting period, sometimes up to 7 months, for coverage for certain enrollees. Beginning in 2023, coverage for Medicare will start one month after the participant enrolls.

A group of Democrats recently reintroduced legislation in the Senate to lower the Medicare qualification age from 65 to 50. If passed, this would mean millions more Americans would become eligible for Medicare. Proponents of the legislation contend that getting folks on Medicare could save lives and provide much-needed care. They point to the fact that care is delayed because many people don’t have access to private insurance. That delay becomes both financially and physically costly down the road. Opponents, of course, point out the financial strain it would cause on the federal budget. Others argue that expanding Medicare eligibility might encourage more folks to retire at a younger age, putting a strain on the workforce. Hospitals oppose the legislation, as Medicare reimbursement rates are much lower than what the hospital would receive from private insurance plans.

Recent news in the Medicaid world is that work requirements have become all but extinct. Former President Trump made it clear under his presidency that he supported Medicaid work requirements. Medicaid recipients would be required to work, look for work, or participate in volunteer work each month. If the requirement wasn’t met, Medicaid coverage would be lost. There were several exceptions to the rule, such as for pregnant women, full-time students, primary caregivers to dependents, the elderly, and the disabled.

Several states submitted Medicaid waivers to implement Medicaid work requirements, and some were approved. Arkansas was the first state to implement such a work requirement policy. They had their program in place for about a year before a federal judge halted it. While litigation was pending, President Biden was elected. He has made it clear that his administration does not support Medicaid work requirements, and so those will not be implemented by states going forward.

Plan for Your Financial and Healthcare Future

Medicare and Medicaid are two very different programs with distinct benefits and eligibility criteria. Only Medicaid will cover long-term care expenses for more than 100 days. Getting long-term care Medicaid can be a tedious process, and legal strategies can be employed that will help you protect assets while getting needed care.

If you or someone in your care needs long-term care soon, or you would like to be proactive and protect assets in advance for more asset protection, then an elder law attorney can be in your corner and help you navigate the legal strategies available to you.

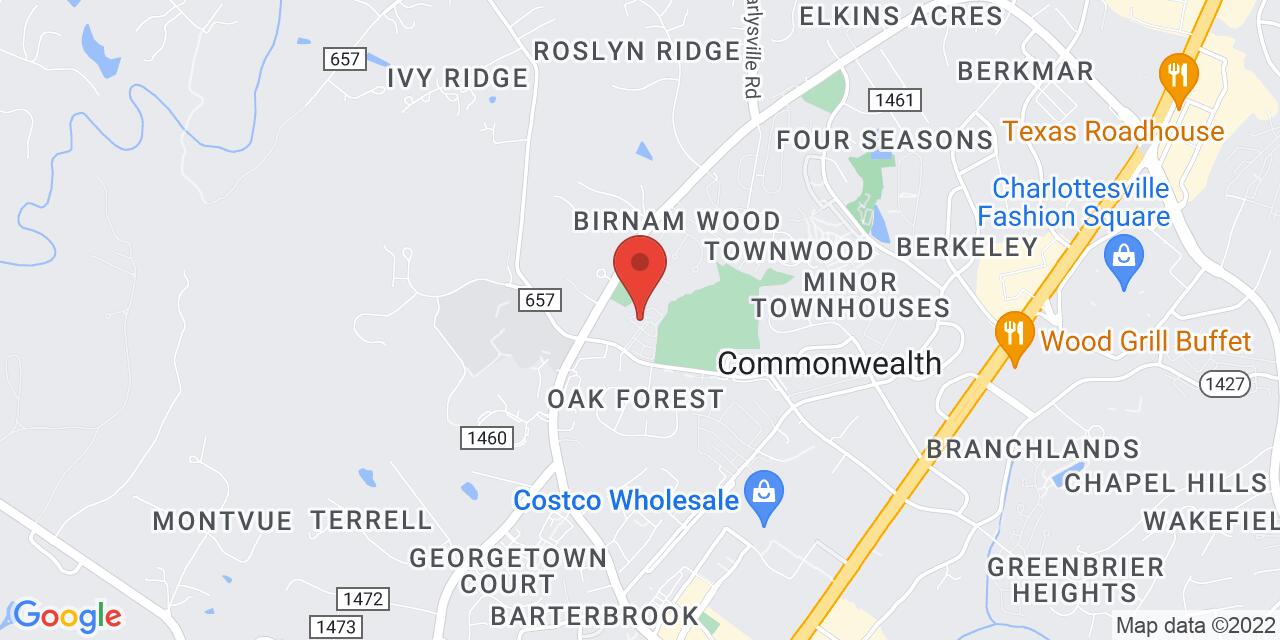

As a former nurse, our founding attorney, Beth Norton, has a rich background in the legal and healthcare needs of seniors in the Charlottesville area.

Schedule a no-cost initial consultation with our team at Norton Health Law, P.C. Contact us through our online form or call (434) 978-3100.